TRON (TRXUSDT) Analysis

TRON (TRXUSDT): A Technical Breakdown and Price Analysis | February 2, 2025

Level up your crypto trading with 35 years of combined market expertise. Eli R. Brown Crypto Research now features veteran market analyst Bruce Powers (CMT). Expect weekly trade signals (entries, stops, targets) for top crypto pairs and trending coins. Plus, get ready for Discord access, algorithmic strategies, and video calls.

Please note that all cryptocurrency charts use the Binance price feed for consistency, unless otherwise specified.

This information is for educational purposes only. Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.

TRON (TRXUSDT) Analysis

Weekly Chart

Observations - Weekly

Signs of a top in TRXUSDT showed recently following a new high of $0.4500 during the week of December 2. Notice that the week ended with a large topping tail and wide trading range, which are signs of trend exhaustion as demand slows.

Also pointing to that high as a possible top is the harmonic relationship with the previous bearish retracement from the 2021 peak. A 300% extended retracement of the 2021 correction completed at $0.45, exactly at the high. Coincidence?

Judging by the subsequent bearish reaction it seems the market recognized that relationship. This means that a deeper bearish correction than what has been seen to date could be possible.

Daily Chart

Observations - Daily

A continuation of the bear trend triggered with a breakdown of a pennant pattern (small symmetrical triangle) on a decisive drop below $0.2391 on Sunday.

Resistance of the pennant consolidation pattern was seen around the 50-day MA and a top rising channel line, which shows prior support becoming resistance.

Notice support was clear at the 50-day line on December 20 and then distinctly resistance on the one day spike on January 18. These are signs of a progressing downtrend.

The confluence of the 200-day MA and 78.6% Fibonacci retracement, at $0.1906 and $0.1883, respectively, indicates the most obvious initial downside target zone. A secondary target is at the 2021 peak of $0.1800.

Trade Idea #1 - Daily Chart (make the trade your own)

Enter SHORT on pullback to prior support area (now resistance) around the bottom of the pennant.

The January 29, 2025 low can be used at $0.2360 for a possible entry slightly below that level at $0.2355.

Stop Loss Level:

Full Stop: $0.2465 (Above Sunday high of $0.2463)

Trailing Stop. Once in profits and approaching the initial target, use a trailing stop.

Take-Profit Targets:

Take-Profit Target 1 (TP1): $0.1907

Targets 200-day MA.

Reward: $0.0446

R:R: 4.1

Take-Profit Target 2 (TP2): $0.1802

Targets 2021 peak for potential support.

Reward: $0.0551

R:R: 5.0

Trade Idea #2 - Daily Chart (make the trade your own)

More aggressive entry as chance of being stopped out on short-term strength increases.

Enter SHORT on drop below the prior trend low and bottom of pennant at $0.2168 ($0.2164).

Stop Loss Level:

Full Stop: $0.2244 (Above Jan. 20 low at $0.2241)

Take-Profit Targets:

Targets are the same as Idea #1.

Take-Profit Target 1 (TP1): $0.1907

Targets 200-day MA.

Reward: $0.0258

R:R: 3.3

Take-Profit Target 2 (TP2): $0.1802

Targets 2021 peak for potential support.

Reward: $0.0363

R:R: 4.6

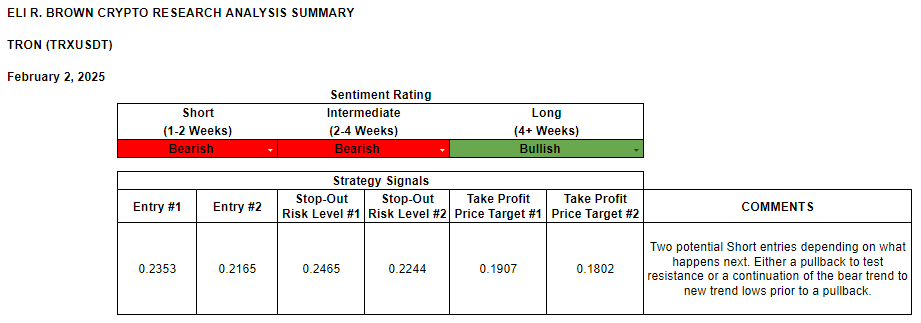

Sentiment Rating & Signals

Thank you for reading! If you have any questions, comments, or feedback leave a comment below.

This information is for educational purposes only. Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.