Happy New Year and Welcome back to Eli R. Brown Crypto Research!

This year, we're on a mission to become the world's leading crypto research newsletter, and I am excited to introduce our new contributing author, Bruce Powers (CMT). With over 25 years of experience in financial markets, Bruce specializes in stocks, ETFs, Forex, cryptocurrencies, and commodities. He has authored hundreds of articles on trading and technical analysis, publishes daily commodity insights on FXEmpire.com, and writes a monthly column for Investopedia on penny stocks. A Chartered Market Technician (CMT) with an MBA in Finance from the University of Arizona, Bruce has also been featured extensively on TV business news and he wrote a weekly column for the Gulf News in Dubai for nine years.

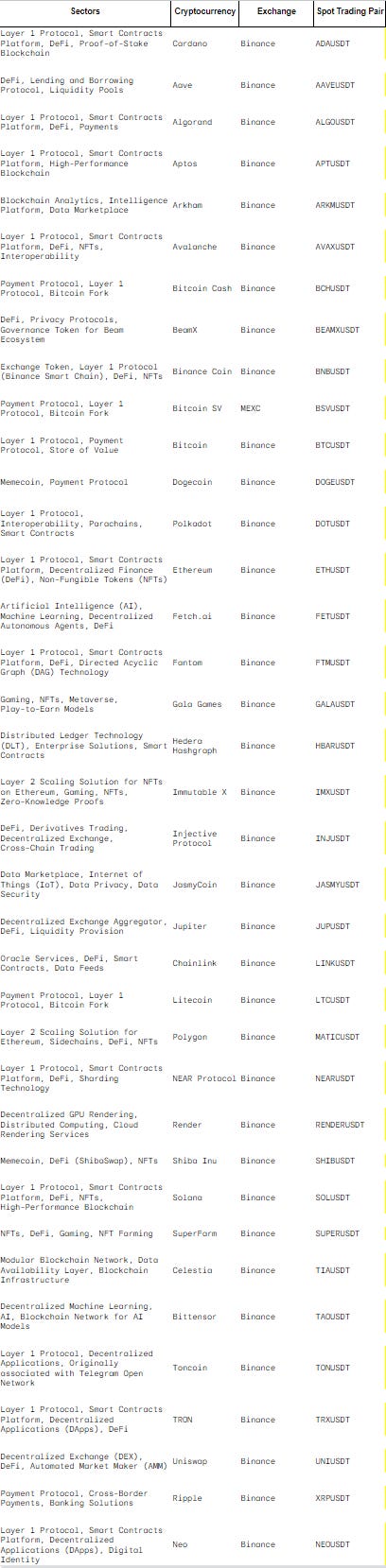

Together, we're committed to consistently delivering the best crypto research in the business. We’ll be providing weekly sentiment ratings, entries, stop-out levels, and take profit price targets of the following crypto pairs along with the odd meme coin or trending coin that has liquidity + momentum:

We’ll have several exciting updates to come in the next few weeks such as accessing our Discord server, accessing our algorithmic crypto strategies, viewing our weekly video calls, and more. Stay tuned for an exciting year!

Please note that all cryptocurrency charts use the Binance price feed for consistency, unless otherwise specified.

This information is for educational purposes only. Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.

Onto our Uniswap analysis…

Weekly Chart

Observations - Weekly

Bull trend showed signs of strengthening as it triggered a higher swing high of $19.47 in early-December.

Subsequently, a trend high of $19.47 was reached on December 8, which led to the current bearish correction. Once the first bottom at $11.22 was established UNIUSDT formed a triangle consolidation pattern on support of top rising channel line (resistance becomes support). Notice that the light blue AVWAP around $12.87 was also in the area of support for the pattern.

Bear trend continuation triggered on Saturday with a drop below the lower boundary line at $12.39, followed by the of the triangle at $11.22, the initial swing low in the correction. Support seen today at a low of $10.34, thereby completing a 61.8% retracement.

Since UNIUSDT has reentered the range of the rising trend channel, there is the possibility it falls to the lower channel line before the correction is complete.

Daily Chart

Observations - Daily

Lower Support

There is a potential lower support zone from $9.59 to the 200-day MA at $9.53. Also, the 78.6% Fibonacci retracement is slightly lower at $9.37 and a 78.6% (less than 100%) target for a falling ABCD pattern (purple) is at $9.17.

It is interesting to note that the AVWAP from the August bottom failed to hold as support during Monday’s drop.

Potential Resistance

Prior swing low from triangle pattern is at $12.02.

AVWAP from August low is around $12.88.

20-day MA is at $13.21 and the 50-day MA is at $14.15.

Bull Strategy

Wait for the trend to evolve and for a more significant potential support zone to be reached. Watch for signs of support around the 200-day MA and lower rising channel line and subsequent bullish reversal.

Anticipated rally back to the top channel line. An AVWAP level is at $12.88 today, close to converging with the channel line.

Bear Strategy

Watch for a rally into resistance at or below the top channel. Then, watch for a bearish reversal setup on the daily or lower time frame for a short and potential continuation of the bearish correction to the 200-day MA target zone.

Sentiment Rating & Signals

Thank you for reading! If you have any questions, comments, or feedback leave a comment below.

For educational purposes only. Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.